Already have a business?

Transfer smoothly your business to MBiA at no additional cost, we will take care of termination notice on your behalf, update the regulatory bodies, setting up our IT solutions and review the compliance status of your business.

The best offer to help you start your business in Asia

MyBusiness in Asia is a brand of RBA and Rosemont Group, providing entrepreneurs and SMEs

high quality services thanks to our deep knowledge

of the regulatory frameworks combined with our unique tech solutions.

Our expertise

MBiA is your one-stop corporate service provider for incorporating and operating your business in Singapore and Hong Kong:

Company Formation, Corporate Secretary, Accounting, Corporate Taxation, HR & Payroll outsourcing, Visas and Immigration Assistance, Company Structuring, Audit Liaison, Business Advisory, Bookkeeping. Our services are fully integrated and digitalized to provide high-quality and swift response to your needs.

Our strengths

We complement our virtual offerings with established and recognized know-how from experts

thoroughly familiar with Singapore & Hong Kong’s regulatory frameworks.

Tailored for

Entrepreneurs, SMEs

and start ups

MBiA works with Entrepreneurs, Startups and SMEs to streamline their accounting, tax, payroll compliance and get rid

of the hassle of company admin. We deliver high quality services from certified professionals at attractive costs thanks

to our digital solutions.

Experienced

Professionals

MBiA, as a brand of RBA Group, has access to certified accountants, tax advisors, highly qualified corporate secretaries who can help guide clients through the intricacies of the modern accounting, HR and tax requirements.

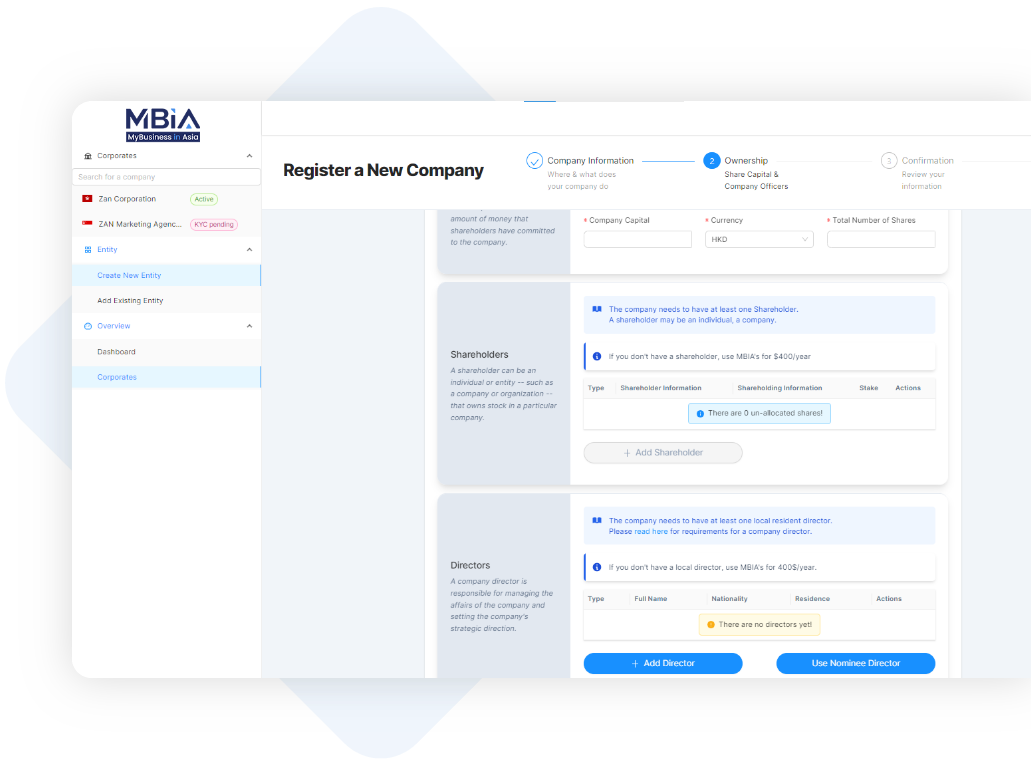

Learn MoreDigital Solutions

Our integrated IT solutions make communication simple and managing your business effortless. Accounting, Tax, Payroll and Administration of your business are all done through our own digital solutions.

Learn MoreIntegrated Services

With partners in strategic locations and thanks to our professionally qualified, experienced, and multilingual staff, we are able to offer an integrated service covering the important areas of interest to clients and their companies.

Learn MoreHow can we help you

- We can help you set up and start your business in Singapore and Hong Kong

- We can help you in structuring your business to maximize the growth of your business

- Through RBA group’s network of offices, we can help you expand your business activities everywhere in Asia

- Our Certified Professionals have the required skills to assist you with specific issues as well as ensuring a smooth business as usual activity.