Incorporation for Foreigners in Singapore & Hong Kong

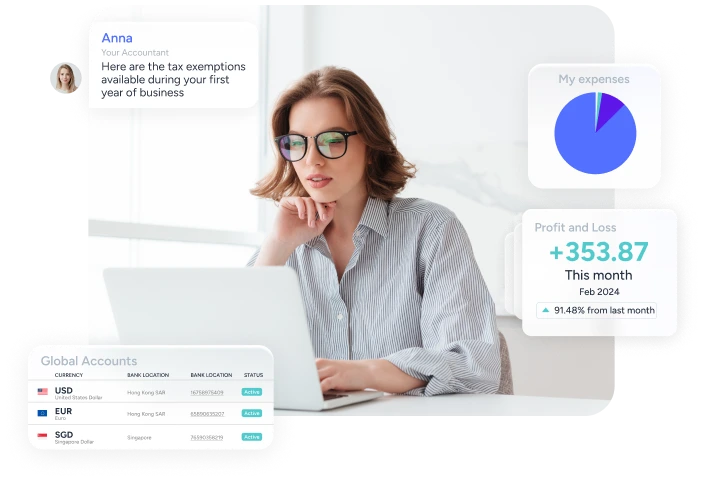

5-in-1 Tax, Finance & Accounting for Foreigners (SG & HK)

Business growth, tech augmented for our experts to handle your Accounting, Taxes, Payroll and Visa matters

STATISTICS

Expanding Your Business in Asia with

MBiA’s One-Stop Business Solutions

OUR SERVICES

Your Business Challenge is Our Expertise

Navigate Corporate Challenges with the backing of our skilled professionals. Our role is to manage all your administrative needs with deep expertise, allowing you to concentrate on business growth. Enhanced with cutting-edge technology, we propel your company towards success.

Due Diligence

Submit your documents for secure KYC verification

< 1 day

E-sign & Incorporate online

Effortless e-signature of incorporation documents and e-filing by our team

1 - 2 days

Due Diligence

Submit your documents for secure KYC verification

< 1 day

Business account opening

Your company is operational with an online account to pay and invoice

< 7 daysINCORPORATE

Seamless Company

Incorporation

Creating your company in Singapore and Hong Kong is easy and efficient. Get your business incorporated remotely and ready in just 2 days.

PACKAGES

Select the Package for Your Business

Our packages provide comprehensive compliance for the entire suite of selected services.

We bring you reliability and peace of mind.

Essential

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Register of Registrable Controllers

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Advance

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Register of Registrable Controllers

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Accounting

• Quarterly Management reports

• Year-end Finalization of the accounts

Tax

• Preparation and Filing of Annual Tax Return (Form C or Form C/S)

• GST registration and GST quarterly filing (if required)

Expansion

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Register of Registrable Controllers

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Accounting

• Quarterly Management reports

• Year-end Finalization of the accounts

Tax

• Preparation and Filing of Annual Tax Return (Form C or Form C/S)

• GST registration and GST quarterly filing (if required)

Payroll

• Calculation of payments for social contributions (CPF, SDL)

• Preparation and filing of Employer’s Return (Form IR8A)

Essential

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Significant Controllers Register

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Advance

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Significant Controllers Register

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Accounting

• Quarterly Management reports

• Year-end Finalization of the accounts

• Audit liaison with appointed auditors (up to 4 hours)

Tax

Expansion

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Significant Controllers Register

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Accounting

• Quarterly Management reports

• Year-end Finalization of the accounts

• Audit liaison with appointed auditors (up to 4 hours)

Tax

Payroll

• Calculation of payments for social contributions (MPF)

• Preparation and filing of Employer’s Return (BIR56A and IR56B)

TESTIMONIALS

What Our Clients Say About MBiA

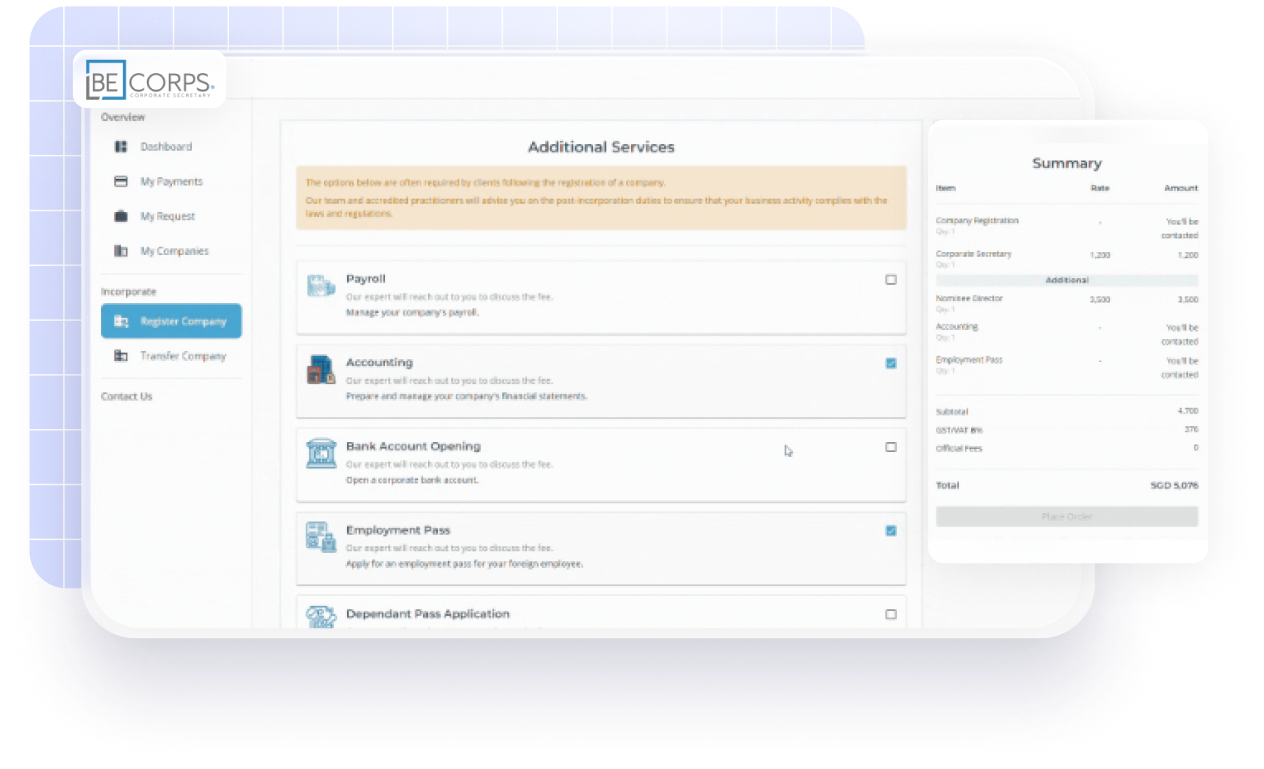

BECORPS

Manage Your Company in One App

Incorporate, Access and Manage your company from our tech platform. Retrieve all your company documents, visualize the shareholding structure, request change of company details.

They trust us

Our Tech partners

AWARDS

Our Group Awards

CONTACT US

Get in Touch!

Connect with our Experts to explore and discuss your project in Asia!

One-stop business solutions for

foreign investors founders regional directors freelancers digital nomads

MBiA Singapore MyBusiness in Asia Pte. Ltd.

31 Boon Tat Street #02–01, Eagles Center, Singapore 069625 Singapore

MBiA Hong Kong MyBusiness in Asia HK Limited

Unit 1303, 13/Floor, Hollywood Centre, 233 Hollywood Road, Sheung Wan

Newsletter

Copyright © MyBusiness in Asia Pte. Ltd. 2025. All rights reserved.