For entrepreneurs and business owners in Singapore, understanding the intricacies of the Work Permit Quota system is paramount. This guide aims to unravel the complexities surrounding foreign worker quotas, eligibility criteria, and the advantages of fostering a diverse workforce. Let’s delve into the core principles that underpin small business operations in Singapore’s dynamic economic landscape.

- Deciphering Singapore’s Work Permit Quota

- Deconstructing the Foreign Worker Quota

- Cracking the Quota Calculation Conundrum

- Eligibility Criteria for Foreign Workers

- Embracing Diversity: The Key to Success

- Concluding Insights

Singapore’s work permit quota

At the heart of Singapore’s labor policies lies the Work Permit Quota, a mechanism devised to maintain equilibrium in the workforce by balancing local and foreign talent. Spearheaded by the Ministry of Manpower (MOM), this quota system delineates the permissible ratio of foreign workers across various industries. The rationale is clear: to mitigate over-dependence on international labor while nurturing domestic talent.

The determination of your business’s Work Permit Quota hinges on several factors, including industry classification, company size, and the Dependency Ratio Ceiling (DRC). The DRC serves as a crucial metric, representing the maximum proportion of foreign workers permitted relative to the total workforce. While stringent regulations govern the employment of foreign workers, MOM offers avenues for flexibility through schemes such as Dependency Ratio Ceiling Exemptions and Sectoral Manpower Plans. These initiatives cater to the nuanced needs of businesses while upholding regulatory integrity.

Mastering the nuances of Singapore’s Work Permit Quota empowers employers to navigate hiring practices adeptly, fostering a symbiotic relationship between local talent and international expertise to propel Singapore’s economic trajectory forward.

Deconstructing the foreign worker quota

The Foreign Worker Quota in Singapore serves as a linchpin in the nation’s labor framework, orchestrating the balance between domestic and foreign employment. But how does this intricate mechanism operate? Each sector is allocated a specific quota, delineating the permissible percentage of foreign workers vis-a-vis the total workforce. Employers must meticulously calculate their quota, factoring in variables such as DRC and sector-specific requisites.

Once the quota threshold is reached, companies are precluded from recruiting additional foreign workers unless stringent criteria are met or requisite approvals secured.

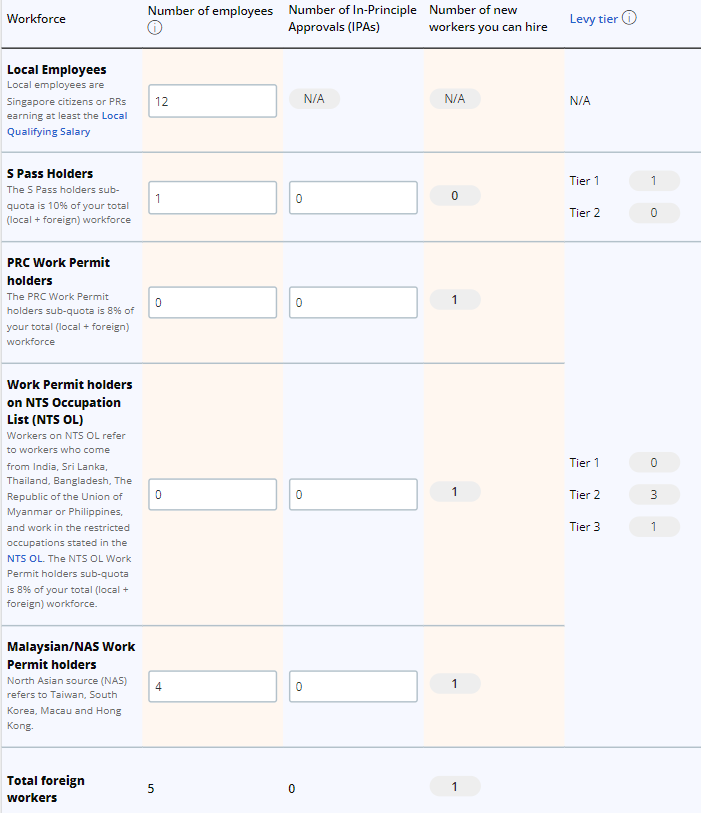

Here’s an example based on a company operating in the Service industry.

Currently, the DRC, or quota, the maximum ratio of foreign workers to the total workforce that a company in the service sector is 35%. In addition, the number of DRC Work Permit holders hirable is limited by a DRC sub-quota capped at 8% of the total workforce (in the service sector)

The company’s current workforce is composed of 12 Local Employees, 1 S Pass holder, and 4 Malaysian/NAS Work Permit holders. In this scenario, the company is allowed to hire 1 work Permit Holder before maximizing its quota. Before hiring another talent under the quota scheme, the company will need to increase the number of local employees.

The data contained in this image is sourced from Ministry Of Manpower.

Cracking the quota calculation conundrum

For small businesses in Singapore, computing the Foreign Worker Quota is akin to navigating a labyrinthine puzzle. The formulaic derivation necessitates a comprehensive assessment of local and foreign employee counts vis-a-vis the DRC.

By meticulously computing the DRC and Total Workforce Count, businesses can ascertain their available quota for recruiting foreign workers. This iterative process demands annual recalibration to accommodate workforce fluctuations.

By wielding a nuanced understanding of quota calculation methodologies, small enterprises can seamlessly harmonize regulatory compliance with strategic workforce management.

Here is the current quota requirement in Singapore for the different sectors:

| Sector | DRC |

| Construction | 83.3% |

| Process | 83.3% |

| Marine shipyard | 77.8% |

| Manufacturing | 60% |

| Services | 35% |

MOM will use the information from the company’s CPF accounts to compute the exact number of local employees at any point in time. Via the CPF account the MOM is able to assess the social contributions paid by the company for its employees; thus it’s crucial to declare their salaries and CPF contributions accurately, and on time.

For the quota calculations, A Singaporean or Permanent Resident employee is considered as:

- 1 local employee if they earn at least $1,400 per month; or

- 0.5 local employee (0.5 LQS count) if they earn half the LQS of at least $700 to below $1,400 per month.

Eligibility criteria for foreign workers

Unlocking the gateway to foreign talent necessitates adherence to stringent eligibility criteria. Businesses must secure a valid Work Permit quota before embarking on recruitment endeavors, ensuring alignment with government-mandated thresholds. Transparent advertising of job vacancies on national portals is mandated to uphold fair employment practices and foster inclusivity. Furthermore, employers must exhibit a commitment to nurturing local talent, offering competitive remuneration packages and robust training frameworks. By adhering to these eligibility prerequisites, businesses fortify their commitment to cultivating a diverse workforce.

Embracing diversity: The key to success

A balanced workforce is the cornerstone of small business success, epitomizing inclusivity and innovation. Embracing diversity catalyzes creativity, fosters customer-centricity, and enhances employee retention rates. By harnessing the collective prowess of a heterogeneous workforce, businesses in Singapore can chart a trajectory towards sustained growth and resilience.

Concluding insights

Navigating the labyrinth of Work Permit Quotas in Singapore demands unwavering diligence and strategic foresight from small business owners. By aligning with regulatory mandates and fostering diversity, enterprises can sow the seeds of sustainable success in Singapore’s vibrant economic landscape.