The Employment Act of 1968 is Singapore’s primary labour legislation which governs the relationship between the employer and the employees in an organization. The main purpose of the Act is to maintain good employment standards and safeguard working conditions for employees.

Employment related regulations are an important area of legal requirements that Singapore companies must follow. All businesses, in their capacity as an employer, need to comply with the employment laws when hiring, managing, and terminating employees.

It is important for an employer to decide the terms and conditions of an employment contract in accordance with the provisions of the employment law. This article will explain the key provisions of the Employment Act that a company should be aware of.

In this article, we will cover:

Applicability of the act

In general, all employees working under an employment contract are covered.

The Act covers all individuals who are working under a contract of service with a company. It is valid both for local and foreign workers.

The terms stipulate that an employee can work:

- A full-time job

- A part-time job

- Temporarily

- Under a special contract

Individuals not covered by the Employment Act can find their terms and conditions in the employment contract they sign.

However, there are certain exceptions.

- Seafarers

- Domestic workers

- Civil servants and statutory board employees.

For instance, Part IV of the Act dedicated to rest days, hours of work, and other conditions of service, does not deal with managers or executives.

Who is covered under Part IV?

Part IV stipulates terms and conditions regarding rest days, hours of work, and other conditions of service.

It only applies to:

- A workman (manual laborer) earning a basic monthly salary of not more than $4,500.

- An employee who is not a workman, but is still covered by the Employment Act and earns a monthly basic salary of not more than $2,600.

- Keep in mind that Part IV of the Act does not pertain to managers or executives.

Does the employment act cover foreigners?

Singapore’s Employment of Foreign Manpower Act (EFMA) regulates the employment of foreign employees and protects their well-being.

In addition, the Employment of Foreign Manpower Act prescribes all the necessary responsibilities and obligations for employing foreign employees in the city of Singapore. It deals with regulations and enforcement regarding offences and work passes.

The EFMA lists different responsibilities related to work passes, applications, cancellations, medical insurance, levy, cancellation, and repatriation.

Foreigners covered by the Singapore Employment Act are entitled to:

- Salary

- Hours of work, overtime, and rest days

- Public holidays

- Annual leave

- Sick leave

As an employer, you are encouraged to have a solid written employment contract with foreign employees that covers these areas.

Employment contract

The Employment Act has a direct effect on the employment contract and the way it is drafted. The Employment Act specially states that any terms and conditions of the employment contract that are less favourable to the employees are illegal, and have no legal binding on the parties. Thus, the terms of the employment contract must be in accordance with the legal provisions of the Employment Act.

The employment contract is an important legal document as it defines the relationship between the employer and the employee. Typically, the contract defines details such as employee’s scope of work, salary details, overtime payment, rest days, leaves, non-compete etc.

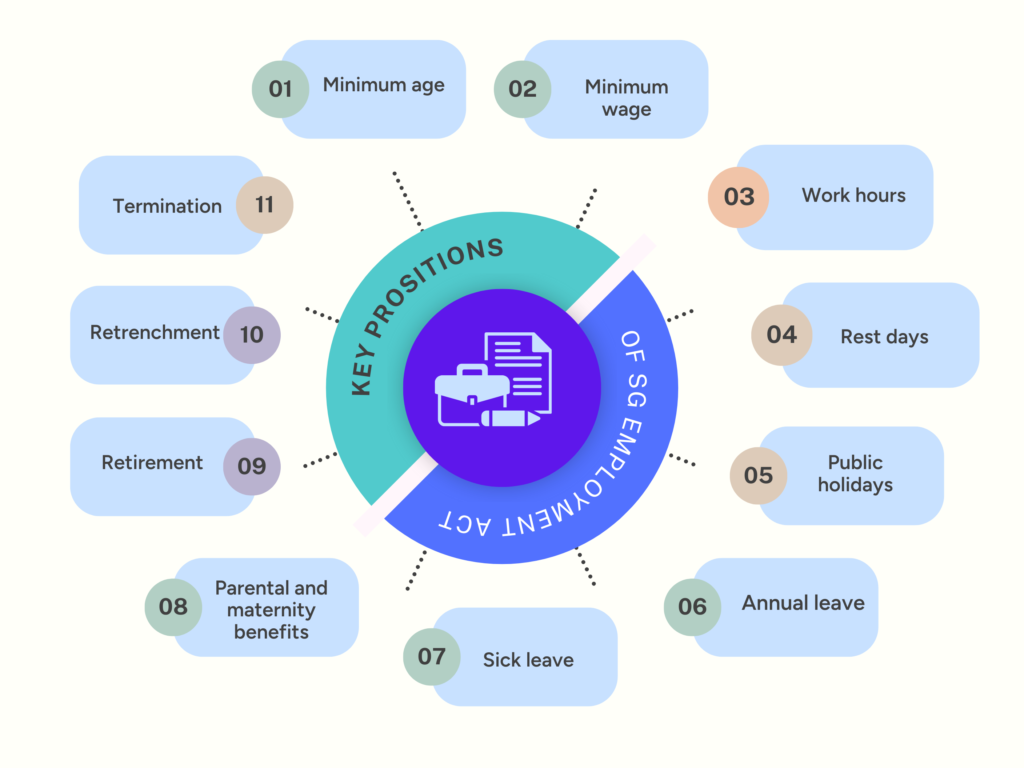

Key provisions of the act

The Employment Act guarantees certain benefits to employees. These benefits include annual leave, sick leave, maternity benefits, paid public holidays etc. Employers must ensure that they fulfil all such requirements in the Act and also draft the terms of the contract accordingly.

Specifically, employers must be compliant with the following provisions of the Act:

Minimum age

All employers have to be aware that an employee needs to be at least 13 years of age to be eligible for any kind of employment. However, the age limit differs depending on the employee’s type of work.

For example, an employer cannot engage individuals aged 16 or below in any workplace with hazardous conditions that can lead to detrimental effects when it comes to a person’s health.

Minimum wage

The wages are stipulated according to the agreed terms of the contract between the employer and the employee. The Employment Act does not prescribe any details regarding the minimum wage for employees.

Work hours

According to the Act, the usual working hours of an employee are 8 hours a day up to a maximum of 44 hours a week. On top of that, no employee should work consecutively for 6 hours a day without any break.

Employers have to confirm the hours of work in the employment contract. The work hours do not include break-time for any meals, drinks, or rest.

Rest days

All employees are entitled to one rest day each week without pay. The rest day is either Sunday or any other day of the week.

If an employer can’t allow an entire day for rest to a shift worker, the rest day has to be a continuous period of 30 hours.

Public holidays

Employees are guaranteed a total of 11 paid public holidays every year. The employer can replace the public holiday for another day by specifying the term in the agreement made between the two parties.

If a public holiday falls on any of the rest days, the next working day is considered a paid holiday. However, bear in mind that if an employee works on that day, the employer has to pay the employee full day’s pay.

Annual leave

An employee is guaranteed a paid annual leave if they have been working for the employer for at least three months. The number of days of annual leave is based on the years of service completed by the employee in the company.

For example:

- For 1 year of service, an employee is entitled to 7 days of annual paid leave.

- For 2 years of service, an employee is entitled to 8 days of annual paid leave.

- For 8 or more years of service, the employee is entitled to 14 days of annual paid leave.

Sick leave

An employee is guaranteed paid sick leave. However, they have to meet the conditions listed below:

- The employee must have been working for the employer for at least 3 months.

- They must tell their employer about their absence within a timeline of 48 hours.

- They need to submit a certificate by a company’s doctor or a government doctor.

- The number of days of sick leave an employee is entitled to depends on the years of service completed.

Parental and maternity benefits

According to the Act, a working mother can claim paid maternity leave and working parents can claim paid child care leave upon fulfillment of certain conditions.

For an employee to claim leave of this kind, they must have completed at least 3 months in service. On top of that, the child for whom the employer provides such benefits has to be a citizen of Singapore.

Retirement

According to the Retirement and Re-employment Act, the minimum age for retirement is 62 years. An employer cannot ask any of its employees to retire before that age. Additionally, employees who reach the retirement age can be re-employed up to the age of 65. However, only Singapore citizens and permanent residents are eligible for re-employment.

Retrenchment

Retrenchment means the involuntary or forced layoff of an employee. The Act states that an employee is entitled to retrenchment benefits only if the employee has been in continuous service with the employer for a period of minimum 2 years. The Act, however, does not specify any concrete retrenchment benefits. The employer and the employee can mutually agree on these benefits at the time of signing the contract.

Termination

The employment contract must state the way in which either party can terminate the contract. A contract is terminated either by the employer or the employee. If there is no clause in the contract explaining the termination process, the termination provisions of the Employment Act are applicable.

The contract can be terminated either:

- With Notice

- Without Notice or

- On grounds of misconduct

The parties can terminate the contract on the basis of a written notice. However, both the employer and employee must follow the notice period in the contract. In case the contract does not specify any notice period the notice period of the Act is to be followed. Where either of the parties commits a material breach of any of the contractual terms, the contract can be terminated without any written notice.

Lastly, if any employee is guilty of misconduct (such as theft, dishonesty, or negligence) an inquiry should be held on the matter, pursuant to which the employee can be dismissed. The Act does not prescribe any procedure for an inquiry. However, as a general guideline, the employer must:

- Inform the employee of the misconduct,

- Ensure that the person hearing the inquiry is not in a position of bias, and

- Give the employee an opportunity to present his case.

The Act states that during the inquiry procedure, the employer can suspend the employee from work for a maximum period of one week. In case the employee feels that he or she has been unfairly dismissed, the employee can appeal to the Employment Claim Tribunal (ECT) within one month of the dismissal.

Penalties

Failure to comply with the provisions of the Employment Act attracts a fine of $5,000 or imprisonment of 6 months or both for each violation. In the case of a subsequent offense, the fine is up to $10,000 or imprisonment up to a year or both.

Conclusion

Singapore has long been recognized as one of the best cities for business thanks in part to its non-bureaucratic, business-friendly labour laws. Entrepreneurs appreciate the high degree of transparency and reliability in business, economic and regulatory affairs in Singapore. A stable political structure with parliamentary democracy, a well-established judicial system, and the presence of strong domestic institutions with good corporate governance practices, have made the Singapore business environment very attractive to global investors

.