Bank Accounts Services

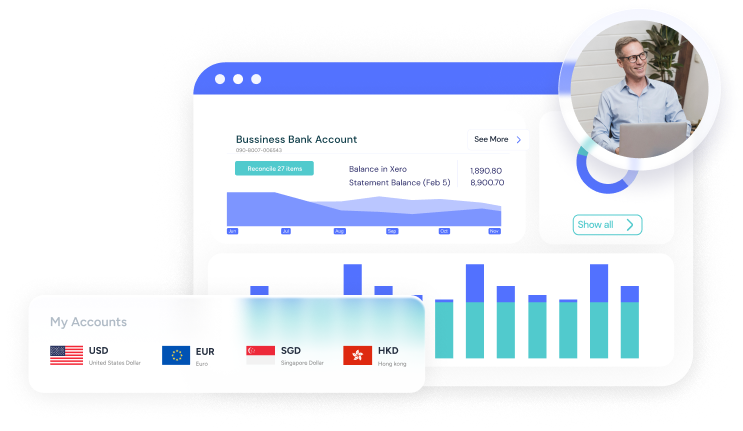

Swift Bank Account Opening

Your corporate account opened in no time, enjoying global features and lower fees

Swift Account Opening to Kickstart Your Business

MBiA partners with payment service providers and banks to streamline the bank and business account opening process. We recognize that a company's incorporation is not complete until it is capable of managing financial transactions. Our team is proficient in the requirements of banks and payment solution providers for opening comprehensive accounts with international capabilities and foreign exchange features. Beyond just forming your company, we ensure it's fully prepared to conduct business!

INCLUDED IN OUR PACKAGES

Bank Accounts Services

ADVANTAGES

How MBiA Assists You

MBiA helps corporate and private clients grow in complex Asian markets.

ADVANTAGES

How MBiA Assists You

MBiA helps corporate and private clients grow in complex Asian markets.

PACKAGES

Select the Package for Your Business

Our packages provide comprehensive compliance for the entire suite of selected services.

We bring you reliability and peace of mind.

Essential

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Register of Registrable Controllers

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Advance

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Register of Registrable Controllers

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Accounting

• Quarterly Management reports

• Year-end Finalization of the accounts

Tax

• Preparation and Filing of Annual Tax Return (Form C or Form C/S)

• GST registration and GST quarterly filing (if required)

Expansion

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Register of Registrable Controllers

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Accounting

• Quarterly Management reports

• Year-end Finalization of the accounts

Tax

• Preparation and Filing of Annual Tax Return (Form C or Form C/S)

• GST registration and GST quarterly filing (if required)

Payroll

• Calculation of payments for social contributions (CPF, SDL)

• Preparation and filing of Employer’s Return (Form IR8A)

Essential

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Significant Controllers Register

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Advance

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Significant Controllers Register

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Accounting

• Quarterly Management reports

• Year-end Finalization of the accounts

• Audit liaison with appointed auditors (up to 4 hours)

Tax

Expansion

Registered address

• Reception Company’s mails

• Scanning and digital forwarding of mails

Corporate Secretary

• Lodging and review of the Significant Controllers Register

• Preparation and filing of the Annual General Meeting and Annual Return

• Reminders of business deadlines and requirements

• Signing of company resolutions when required

Accounting

• Quarterly Management reports

• Year-end Finalization of the accounts

• Audit liaison with appointed auditors (up to 4 hours)

Tax

Payroll

• Calculation of payments for social contributions (MPF)

• Preparation and filing of Employer’s Return (BIR56A and IR56B)

ADD-ONS

Add-ons You Might Need

Selected Add-ons to supplement Packages by offering greater business freedom

Which Package Fits Your Business?

Discuss with us in a free call to better assess your corporate needs and determine how MBiA can assist you the best! We cover all your requirements and ensure a smooth service delivery.

Frequently Asked Questions

CONTACT US

Get in Touch!

Connect with our Experts to explore and discuss your project in Asia!

One-stop business solutions for

foreign investors

founders

regional directors

freelancers

digital nomads

MBiA Singapore MyBusiness in Asia Pte. Ltd.

31 Boon Tat Street #02–01, Eagles Center, Singapore 069625 Singapore

MBiA Hong Kong MyBusiness in Asia HK Limited

Unit 1303, 13/Floor, Hollywood Centre, 233 Hollywood Road, Sheung Wan

Newsletter

Copyright © MyBusiness in Asia Pte. Ltd. 2025. All rights reserved.