Bookkeeping is the process that involves the recording and tracking, on a regular basis, of a company’s financial transactions. The role of the bookkeepers is to enable the company to track and meticulously summarize all the business activities in its books, allowing the business to access up-to-date and comprehensive reports.

In accordance with the local and international accounting principles, each and every transaction must be reported in the company’s books – whether it refers to a sale or a purchase.

Bookkeeping is a function needed by all companies, from Small and Medium to Large Multinationals, and it is not industry or sector specific. Know more about Bookkeeping Services Singapore just below.

- What is the role of bookkeepers?

- Why Bookkeeping is important?

- Why outsource your bookkeeping?

- FAQs – Frequently Asked Questions related to Bookkeeping

What is the role of bookkeepers?

The role of bookkeepers is crucial in any business organization. Essentially, the task of bookkeepers is to record, following specific methods, all the numbers of the financial transactions of a business in an organized way. The reports prepared by bookkeepers are used by decision makers within a business organization to take informative strategically key decisions.

Check our Corporate secretarial services Singapore, Accounting services Singapore, all about Sole Proprietorship Singapore and How to Register a business in Singapore.

Bookkeepers core activities

- Data Entry: recording transactions by using an accounting software or database

- Manage the account receivables cycle of a company: prepare and issue to clients sales invoices for the sales of goods or services, and tracking the payments of such invoices

- Manage the account payables cycle of a company: collect, review and organize all the purchase invoices received form suppliers and ensure they are paid according to the agreed payment terms

- Prepare the payroll reports for the company: calculate the gross and net pay for all the employees, including any social contributions, deductions or variable compensation elements. All in accordance with the terms and conditions of the employment contracts and local labor laws.

- Prepare and reconcile Financial Statements: ensure the accounting records and bank account balances matches and generate Balance Sheet, Profit and Loss Statements, Cash Flow statements.

Single or Double Entry Bookkeeping?

Both methods require the use of a Journal, with the single entry being a more simple and straightforward approach of recording transactions. Essentially, the single-entry bookkeeping is comparable to a cash book, where entries details include date, description, transaction value (either a debit or credit) and the remaining balance. The single-entry bookkeeping is typically prone to errors as it doesn’t allow the recording of any asset or liability, and it does not permit to track inventory or sales of products on credit.

On the other hand, the double-entry bookkeeping is most utilized to track the financial health of business organizations. In fact, the double-entry method is based on recording every transaction in at least two accounts, as a debit or a credit. As a result, the amount recorded in the books for credits must match the one for debits.

This principle allows to easily identify errors made in the transactions’ recording: if at any point, the final amount recorded for credits does not equal the correspondent sum of debits, a mistake has been made. In fact, the principle at the heart of the double entry method is the equation.

Assets = Liabilities + Equity

The essential documents used to track and record the financial transactions of a business in the double-entry bookkeeping are the following:

- Journal: where the transactions are chronologically record for the first time in a company document.

- Ledger: this is the summary of all the transactions entered, is a master accounting documents providing the full record that must be balanced.

- Trial Balance: it is a worksheet showing the closing balances of general ledger accounts. Serves the purpose of checking that all ledgers are recorded into debit and credit account column totals that are equivalent.

- Financial Statements: the collection of high-level reports showing the consolidated information recorded on a day-by-day basis. The Financial Statements comprises of three main sections: cash flow statement, balance sheet, and income statement.

Why Bookkeeping is important?

Bookkeeping is an integral and crucial part of every business and, it ensures the basis for the tax calculation are accurate and the company financial representation is truthful and correct.

Most importantly, bookkeeping allows business owners, founders, entrepreneurs, CFOs, CEOs and all decision makers in the company to take informative decisions based on up-to-date records.

Whether the company is facing crucial decisions on assets disinvestments, loans, or acquisitions the reports produce by bookkeepers are the basis of every informative decision.

Keeping an accurate, transparent and updated representation of the company’s financials add a layer of accountability to the business. This is beneficial to all company’s stakeholders: financial institutions are more likely to grant a loan, line of credit or discount invoices, investors have an accurate tool to evaluate the business performs and inject capital in the company, customers are reassured and brand image is consolidated.

Why outsource your bookkeeping?

Being able to carry out bookkeeping for a company requires a high degree of familiarity with local and regional tax codes and accounting principles as well as tax and finance knowledge.

Throughout the years we have gained deep cross-industry experience, which will allow us to assign the best expert and supervisor based on your business model. From single entrepreneurs to SMEs with regional operations, from e-commerce to media companies, our bookkeeping service is available to you.

- Our scalable services adapt to any business and evolve with the complexity of the accounts

- Tax compliance is becoming more and more heavy. Our services will allow you stay ahead of any changes in the tax framework and keeping focus on your business

- Timely and Value-driven reporting made possible thanks to the combination of our IT solutions and team of experts that you can easily contact

- We are Asia experts. Our group offices and cross-border partnerships will help you to expand in Asia developed and emerging markets

Bookkeeping can be a time-consuming and tedious activity, especially for growing business with an increasingly higher volume of business transactions. To allow business owners to focus exclusively to scale and manage their business, MBiA uses the best-in-class cloud accounting software topped by the deep expertise of our certified bookkeepers.

Our accounting and bookkeeping service will provide you with Quarterly Management Accounting Reports, inclusive of Profit and Loss, Balance Sheet, Accounts Receivable, Accounts Payable, Payroll and cash-flow reports.

We cover the full range of accounting services for your firm:

✓ Set up & onboarding on XERO

✓ Quarterly Management Accounting report

✓ Multicurrency Accounting

✓ Year-end finalization of accounts

✓ Year-end Unaudited Financial Statement preparation and filings

✓ Treasury Services and bank connections

✓ Seamless Payroll & Leaves management

✓ Group Accounts Consolidation

✓ Rescue Accounting and reconciliation

✓ Audit assistance

And the full range of Tax services:

✓ Estimated Chargeable Income (ECI) & Corporate Tax Return preparation and filing

✓ GST Registration

✓ Quarterly GST filing

✓ Application to dedicated GST Schemes

✓ Application to Local Tax Credits, Incentives and Tax Schemes

✓ Withholding Tax filings

✓ Yearly Personal Tax Returns

✓ Tax Clearance for Foreign & SPR Employees

FAQs – Frequently Asked Questions related to Bookkeeping

What is the corporate income tax in Singapore?

The tax system in Singapore is single tier, which means for example that after the corporate income tax is paid there is no additional tax payment on capital gains (if they do not constitute a business activity).

The Corporate Tax rate for companies is 17% in Singapore. But there are several tax emptions, incentives and other rules that allow to reduce the amount of payable taxes.

You can find a non-comprehensive list of some of the exemptions on the website of the Inland Revenue Authority of Singapore (IRAS).

Usually, the due date to file the corporate income tax is 15 December (online) on an annual basis, consequently and by this date, the company must have filed its financial statements. Maintaining a proper bookkeeping and producing accurate accounting reports is thus critical for the business. MBiA’s range of services include the preparation of the annual unaudited financial statements.

When is a company considered a Singapore Tax Resident?

For a business to be considered Tax resident in Singapore requires more than being incorporated in Singapore. Indeed, the main criterion if for the business to be controlled and managed from Singapore. More precisely, the Control and Management of a company implies taking strategic decisions in Singapore by for example ensuring that the board of directors are located in Singapore.

Having directors on the Singapore’s company payroll as well as declaring Singapore as their permanent residences also facilitate to be recognized as a corporate tax resident. Companies registered as tax resident can receive certain benefits such as income tax exemption for new start-up companies, exemption for some foreign-sourced dividends and other foreign-sourced service income. Also, the Singapore Tax Resident company benefits from the local Double Taxation Agreements negotiated with other countries.

More than providing only bookkeeping and accounting services, MBiA is able to help you navigate your personal and corporate tax matters. We also guarantee channels to contact us through our digital platform as well as email and video meetings.

What is the individual tax rate in Singapore for resident individuals?

In Singapore, individuals must pay taxes based on their income. The tax rate is progressive and the personal tax management and filing is a consulting service we can offer.

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

| First $20,000 Next $10,000 | 0 2 | 0 200 |

| First $30,000 Next $10,000 | – 3.50 | 200 350 |

| First $40,000 Next $40,000 | – 7 | 550 2,800 |

| First $80,000 Next $40,000 | – 11.5 | 3,350 4,600 |

| First $120,000 Next $40,000 | – 15 | 7,950 6,000 |

| First $160,000 Next $40,000 | – 18 | 13,950 7,200 |

| First $200,000 Next $40,000 | – 19 | 21,150 7,600 |

| First $240,000 Next $40,000 | – 19.5 | 28,750 7,800 |

| First $280,000 Next $40,000 | – 20 | 36,550 8,000 |

| First $320,000 Next $180,000 | – 22 | 44,550 39,600 |

| First $500,000 Next $500,000 | – 23 | 84,150 115,000 |

| First $1,000,000 In excess of $1,000,000 | – 24 | 199,150 |

How do I issue an invoice?

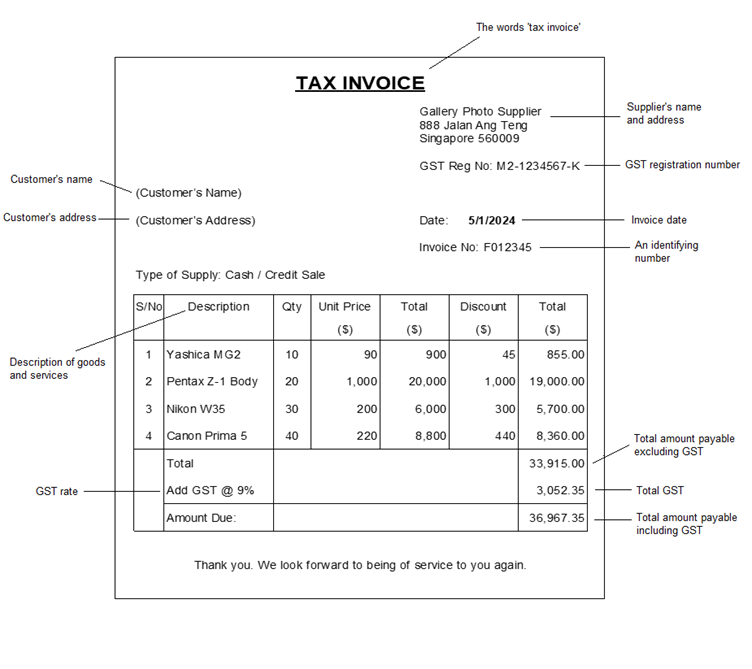

All Singapore businesses registered GST must issue Tax Invoices. A Tax invoice is the most important document to support input tax claim with IRAS. The invoice standards change based on your GST registration and GST filing. Our accountants can also help you with your corporate tax filings in Singapore.

A tax invoice must include all the following information:

The image above is collected from IRAS

Bookkeeping Services Singapore : Our offers

Whether it is the company registration process, accounting, tax filing, or payrolls, businesses have to spend a lot of time on tricky administrative tasks. MBiA has experts who will help your Singapore based company with bookkeeping, accounting, tax, corporate secretary, payroll and we also provide business consulting services. We will focus and ensure of the delivery and filing such the annual financial statements of your company.

What if there was a cost-effective solution that could eliminate all the paperwork, and innovative tools to manage your startup effortlessly? What if a key panel of experts from the best industries was by your side, to take the next step of your business venture?

Check out how our offers enable entrepreneurs, startups and SMEs to start their business journey. Talk to us today!