Nestled in the middle of Southeast Asia, Singapore has stood out as a global hub, offering unparalleled advantages for setting up and expanding businesses. In order to comprehend this brilliant location to incorporate business, entrepreneurs had better make careful plans for flourishing growth or unforeseen challenges.

Our following in-depth guide provides a concise and simplified approach that empowers you to navigate the incorporation process in Singapore with confidence:

- Steps To Incorporate A Company In Singapore

- Documents To Prepare

- Other Considerations For Foreigners

- Frequently Asked Questions

Steps to incorporate a company

Before diving into the process of company incorporation, it is essential to gain a better understanding of the mandatory steps for getting your company successfully incorporated in Singapore.

1. Pick your company name

Companies incorporated in Singapore must have their name proposed in accordance with the general requirements and restrictions. The proposed name must be in English, and terms such as “bank,” “insurance,” “university,” and “education” should be used with careful consideration. Additionally, the proposed company name should not duplicate or resemble existing names listed by Singapore’s ACRA, names prohibited by the Minister, or names that infringe on reserved trademarks or brands.

2. Choose the registered address

An incorporated company in Singapore must have a registered office within the region. Here are some key considerations for your company’s registered address:

- It must be a physical address situated within Singapore, a P.O. Box or virtual office is not eligible.

- It must be open and available to the public for at least three hours each business day during normal business hours.

- Individuals’ residential addresses are permitted.

👉 Read our related article for further information: Registered office address for companies in Singapore

3. Decide on key personnel and share capital structure

Key Personnel

- According to the Companies Act 1967, every Singapore company is required to have at least one resident director on its board all the time. However, it is often challenging for companies to find a local person in Singapore to act as a resident director, especially for offshore companies with primary operations in another country. As a result, using Nominee Directors will be an alternative solution to ensure incorporation requirements and Singaporean regulations compliance.

- A resident director (or local director) can be either a Singapore citizen, permanent resident, or work pass (e.g. Employment Pass, EntrePass) holder.

- A nominee director is a member of the board of directors who does not involved directly in the company’s operating activities. However, they still hold the same legal responsibilities as a resident director and must ensure the company at hand remains compliant with Singapore law (holding AGM on time, maintaining company registers, filing annual returns,…)

- Shareholder: A registered company must have at least 1 shareholder and a maximum of 50 shareholders. Shareholder(s)’ information, including full name, residential address, and ID documents (passport scan, FIN, NRIC number, etc.) should be provided. If the shareholder is a corporate entity, make sure you also have its business profile outlining the shareholder structure, and an authorized representative’s name & ID document.

- Company Secretary: The company secretary must be an individual residing in Singapore, not a corporation, and cannot be the sole director/shareholder. The requirements for detail provision are similar to those for directors.

Share capital structure

Your company constitution will need to include the following share details:

- Number of shares

- Type of shares (ordinary or preference shares)

- Share capital to be issued and currency

4. Register your company in Singapore

To register a company in Singapore, you must first secure approval for your company name from the Singapore Registrar of Companies.

Provide your agent with 3 potential names, and they will verify their availability through the ACRA’s BizFile+ portal, reserving them for 60 days. If necessary, you can extend the reservation for another 60 days while completing your application.

Once your company’s name is approved, you’ll need to gather and submit various documents to ACRA for the registration process.

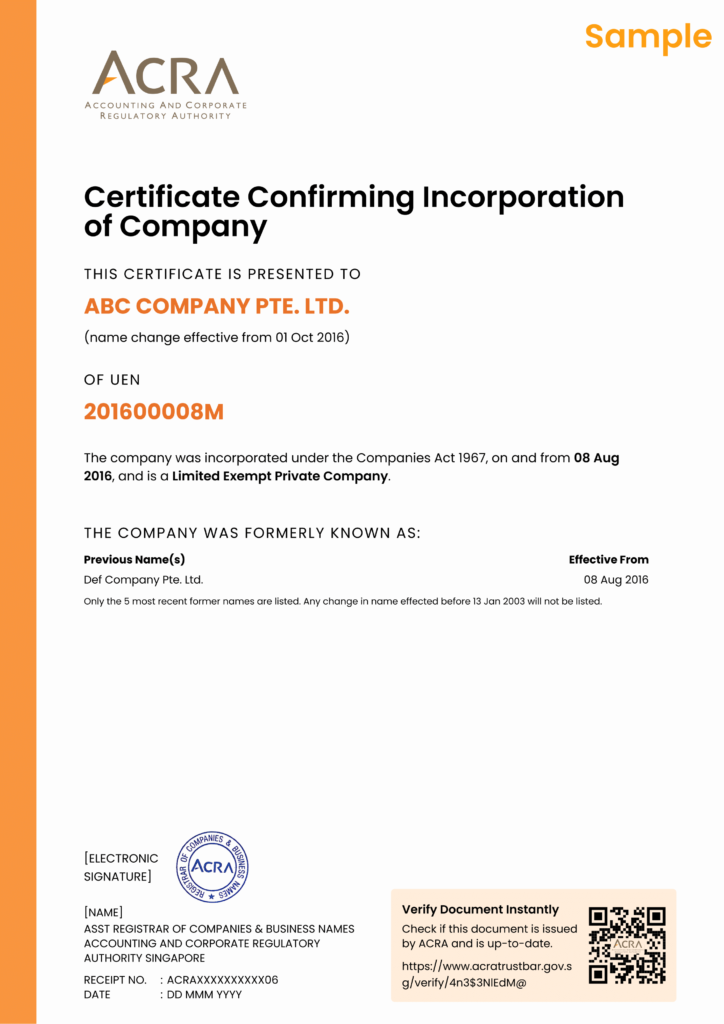

Upon submission, ACRA typically processes your application within an hour. Once your company is successfully registered, ACRA will issue an e-Certificate of Incorporation [view sample], and a Business Profile.

👉 If you’re unsure about eligibility, explore the detailed article we have crafted on how to register a company in Singapore: Register a business in Singapore

5. Set up a corporate bank or business account

Depending on the bank opted for account opening, you may go through the procedure either online or in-person. Some documents typically required to set up a corporate bank accounts are Board resolution with clear indication of any appointment of signatories, Certified copies of directors’ and authorized signatories’ NRICs or passports, an ACRA Business Profile Search, and Company’s incorporation certificate.

If you do not require credit features such as loan, credit revolving and credit card (a debit card is enough for you), then you can consider the opening of a business account. These accounts are offered by payment service providers, regulated by the Singapore MAS. They are easier to open and effective for SMEs unable to fulfill the high requirements of banks in Singapore.

👉 Find more information about business accounts:

- Singapore Business Account to Supplement Company’s Operations

- Open a Business Bank Account in Singapore

- The Ultimate Guide to Company Bank Account Opening In Singapore

6. Secure necessary business licenses or permits

Most businesses in Singapore do not require a business license.

Depending on the type of activity, obtaining a business license may be required before beginning operations. Businesses such as clubs, employment agencies, market places, bars, food and beverage establishments, private educational institutions, telecommunications and InfoCom-related enterprises, manufacturing plants, healthcare providers, and trading entities are among those typically required to apply for licenses.

7. Apply for employment passes for relocation to Singapore

The Employment Pass enables foreign professionals, managers, and executives to work in Singapore, provided they earn a minimum monthly salary of $5,500. Employers are required to demonstrate fair consideration of all job applicants as part of the application process for the Employment Pass.

👉 The eligibility for the Employment Pass is strict yet transparent, if you are not sure where to get started, consider reviewing the different work permits and visas available in Singapore: All you need to know about Work Passes in Singapore

Or, you can also reach out to MBiA’s team to have their advice on which visa would fit your qualifications experience the best!

II. Documents to prepare

Various documents will be required when you incorporate a company in Singapore, which can be complex and time-consuming. Our overview provides a clear understanding of the essential documents and requirements, empowering you to navigate the process and meet your obligations confidently:

- Constitution of the company

- First director resolution

- Appointed company secretary documents

- Register of Registrable Controllers of the company

- Brief details of your business profile and activities

- Company registered address

- Details and identification documents (including proof of address) of shareholders (including corporate shareholders, if any), directors and company secretary

Ensure all documents are accurately prepared, signed, and submitted through your appointed agent, who will initiate the incorporation procedure via ACRA’s BizFile+ portal. Additionally, if any of your documents are not in English, you should have them translated and certified.

III. Other considerations for foreigners

Foreigners interested in registering a company in Singapore should consider the following:

- Professional assistance required: Foreign individuals or entities cannot self-register their company in Singapore. Hence, a professional service provider is needed to handle the registration process, at least at the beginning.

- No need for special visa: If you are not planning to relocate to Singapore, foreigners can still own a Singapore company and operate it remotely.

- Requirement for local director: Even if no one from the company moves to Singapore, there is still a mandatory requirement to have a local director.

- Bank account setup: Depending on the bank chosen, foreigners may need to travel to Singapore to set up a corporate bank account, or they can opt for a business account for simplicity.

If you are thinking of starting your own business in this city-state, look no further! Partner with MBiA and explore what you’ve got in an MBiA’s Singapore-incorporated service package.

MBiA’s Singapore pre-incorporation checklist

It takes a painstaking amount of time, effort and attention for a smooth company incorporation – but it doesn’t have to be. We have already created a concise and action-oriented checklist for pre-incorporation. This handy guide provides a clear roadmap for all the essential steps to successfully launching your Singapore business.

The checklist includes many crucial prerequisites covering foundation steps, corporate and legal representatives, share capital structure, and after-incorporation steps-related documents.

Ensure you are well-acknowledged and fully prepared to meet the requirements. Feel free to contact us for any guidance or support needed regarding incorporation.

In our latest articles, we’ll break down everything you should know before starting a company in Singapore!

- STARTING – My Business in Singapore

- RUNNING – My Business in Singapore

- Launch Your Business With Ease: Startup Incorporation Services In Singapore

- The Best Reasons to Incorporate a Holding Company in Singapore

- 5 good reasons to register a company in Singapore

- Open a Business Bank Account in Singapore

- How to check your company name availability in Singapore

FAQ

1. How long does the company registration process typically take in Singapore?

Applications are typically processed within a few hours minutes after the application is submitted. However, if the application requires approval or review from another agency, the processing time can be significantly longer, ranging from 14 days to as much as 2 months. It is important to plan accordingly and factor in this potential delay when scheduling your company’s incorporation timeline.

2. How much does the company registration process typically cost in Singapore?

To register a private limited company in Singapore, there will be two types of government fees: Name reservation fee and Company reservation fee. ACRA charges a S$ 15 fee for name reservation application and a S$ 300 registration fee.

All in all, if you’re wondering how much it costs to register a company in Singapore, the simple answer is at least S$ 315 to which you can add fees for your service provider.

3. Can I change my company’s business structure after registration in Singapore?

Yes, you have the option to update your company’s business structure using the BizFile+ system, which provides a convenient platform for making such adjustments. Depending on the nature and extent of the changes you wish to make, it may also be necessary to revise your business constitution accordingly. This process ensures that all legal and operational aspects are aligned with your updated business structure, providing clarity and compliance as your company evolves.

4. What is the minimum capital requirement for registering a company in Singapore?

When registering a company in Singapore, you only need a minimum paid-up capital of S$ 1. However, certain work visa applications may require you to maintain a specified minimum paid-up capital amount.