As a member of ASEAN since 1967, Singapore maintains an optimal position within South-East Asia to attract foreign investments. Its entire English legislation makes it very accessible for everyone. Moreover, Singapore offers a secure and stable economic environment which suits perfectly any company project. With low corporate tax and many other conveniences, the Private Company Limited by Shares is the go-to entity form.

In this article, we will cover:

- What is a Private Limited Company?

- Necessary requirements for Private Limited Company Registration

- Establishment process for Private Limited Company

- Post-establishment obligations

What is a Private Limited Company?

Before embarking on the setup procedure, it’s crucial to grasp the nature of the chosen company type. A private limited company possesses unique attributes, including:

- A membership cap of up to 50 individuals.

- Shares being restricted to private ownership and trade, rather than being publicly listed.

- Being recognized as a distinct legal entity, separate from its shareholders and directors.

- Members having limited liability

- Being able to sue or be sued in its name

- Authorization to hold assets and properties under its own name.

- Members not being personally liable for the company’s debts and losses

- Corporate profits being subject to corporate tax rates, typically around 17%.

Necessary requirements for Private Limited Company Registration

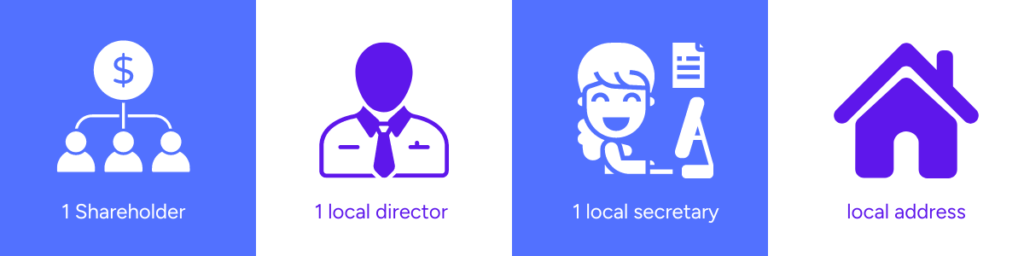

- One shareholder is requested, can be an individual or a company, but this figure can go up to 50 at most (if beyond then a Public Company Limited by Shares is best suited for your needs). There is no mandatory requirement for the shareholder(s) to be resident in Singapore;

- Appoint at least one director whom has to reside in Singapore. The local director can be a Singapore citizen, Permanent Resident or holder of Employment Pass or Entrepreneur Pass. Once you have a local director, you can appoint as many directors as you want;

- The appointment of a company secretary within six months from the date of company incorporation is mandatory. The company must designate a natural person who resides in Singapore;

- Your Singapore company’s head office has to be based in Singapore; and

- As for the capital, the minimum issued must be at minimum S$1. The recommended amount to inject would be minimum S$50,000 if you wish to hire foreign employee(s) under your company.

Establishment process for Private Limited Company

A Private Company Limited by Shares registration is pretty straightforward and efficient in Singapore. All the directors and shareholders are not required to visit Singapore for the company registration. They can sign all the documents overseas.

First off, you will need to choose a name for your company. This procedure is under the jurisdiction of the Accounting and Corporate Regulatory Authority (“ACRA”).

The registration process for your private limited company includes several steps. We’ll guide you through each of these steps and highlight the important factors to keep in mind:

Submit Your Company Name Application

Key considerations when selecting your name include:

- ensuring it is distinct from existing names

- avoiding any inappropriate or unlawful terms

Additionally, you must specify your business activities by selecting the most relevant Singapore Standard Industrial Classification (SSIC) code 2020.

Upon approval of your name application, you have 120 days to complete the incorporation of your Singapore private limited company. If your application requires review and approval from other government agencies, processing may take approximately 14 to 60 days.

Choose a Financial Year End (FYE)

Selecting a fiscal year end (FYE) is crucial as it dictates the deadlines for your business taxes and filings each year.

For private limited companies, it’s mandatory to conduct the annual general meeting (AGM) within six months following the FYE. Additionally, filing annual returns (AR) is required within seven months of the FYE.

For private non-listed businesses with share capital and an overseas branch register, AGM must be held within six months of the FYE, while AR filing should be done within eight months of the FYE.

Annual Filing Requirements

Private limited companies have legal responsibilities, including conducting an AGM and submitting their AR. Even if your company is excused from income tax filing by the Inland Revenue Authority of Singapore (IRAS), you’re still required to submit AR as long as your company remains operational.

Your Private Company Limited by Shares is now officially registered.

Choose Key Personnel

Every Singapore company must have at least one director and a company secretary. Details of appointed company officers, including their names, nationality, home address, contact information, and NRIC, must be submitted.

Directors must:

- Be at least 18 years old and legally competent.

- Hold Singapore citizenship, permanent residency, or valid EntrePass or Employment Pass.

- Not be disqualified from directorship, such as being an undischarged bankrupt.

Note that under the Singapore Companies Act, all directors, regardless of their activity level, share equal liability.

A company secretary must:

- Be a Singapore resident.

- Be an individual and not the sole director.

- Responsibilities include ensuring directors are informed of filing deadlines, updating them on regulatory changes, maintaining company records, and facilitating meetings.

Hiring a company auditor is required within three months of incorporation, unless exempted under the Company Act.

Share Capital

Upon incorporating your private company, it’s necessary to allocate a minimum of S$1 of share capital, known as paid-up capital, to your shareholders. This capital can be issued with partial or full payment from shareholders.

It’s important to be aware that companies with paid-up share capital reaching at least S$500,000 are automatically enrolled as members of the Singapore Business Federation (SBF).

Office Address

When registering your Singapore private company, you’re required to furnish an office address where notices and communications are directed, and where company records are maintained. The address must meet certain criteria:

- Accessibility to the public for at least 3 hours daily during regular business hours on business days.

- Located in Singapore, although it doesn’t necessarily have to be the operational site.

Utilizing a virtual office as your registered office address is permissible, aiding in upholding a professional corporate image.

Post-establishment obligations

Although your company is set-up, it is far from being operational. Please follow the coming steps:

- From now on and pursuant to the Singapore legislation, you are compelled to recruit a local secretary within 6 months;

This requirement also concerns the designation of an auditor under 3 months; - Further the registration of your Singapore company, you will be able to open a bank account with your preferred institution.

- There is a plethora of choice, so make sure to select a bank according to your preferences;

- Then comes the Goods & Services Tax (“GST”) registration phase. This stage is compulsory if your company’s revenue is expected to exceed S$1 million a year. The GST registration is under the jurisdiction of the Inland Revenue Authority of Singapore (“IRAS”) and once registered, you have to declare your GST quarterly.

You are now completely done. Make sure to keep proper accounting records, to prepare a balance sheet and profit and loss account annually and to follow the annual filing requirements of ACRA and IRAS.