Holding Companies, why choose MBiA?

We selected essential services for you to continue running your business efficiently while letting us handle your administrative and compliance requirements with local government agencies. Get ahead with peace of mind as we handle your back-office!

- Go paperless, all your forms and filings appear in your virtual dashboard

- Leverage on our team of industry experts, part of the award-winning RBA Group

- In-house digital corporate services platform and integrated communication service

- Benefit from a ready-to-use business account with multi-currency global wallets located in your most convenient area of business activities: Singapore, Hong Kong, European Union, United States, etc.

- Tailored advises for structuring and administration of your business

Holding Companies Package

Is this package right for your company?

A bespoke package that includes all your needs in compliance with local regulations to manage your holding company

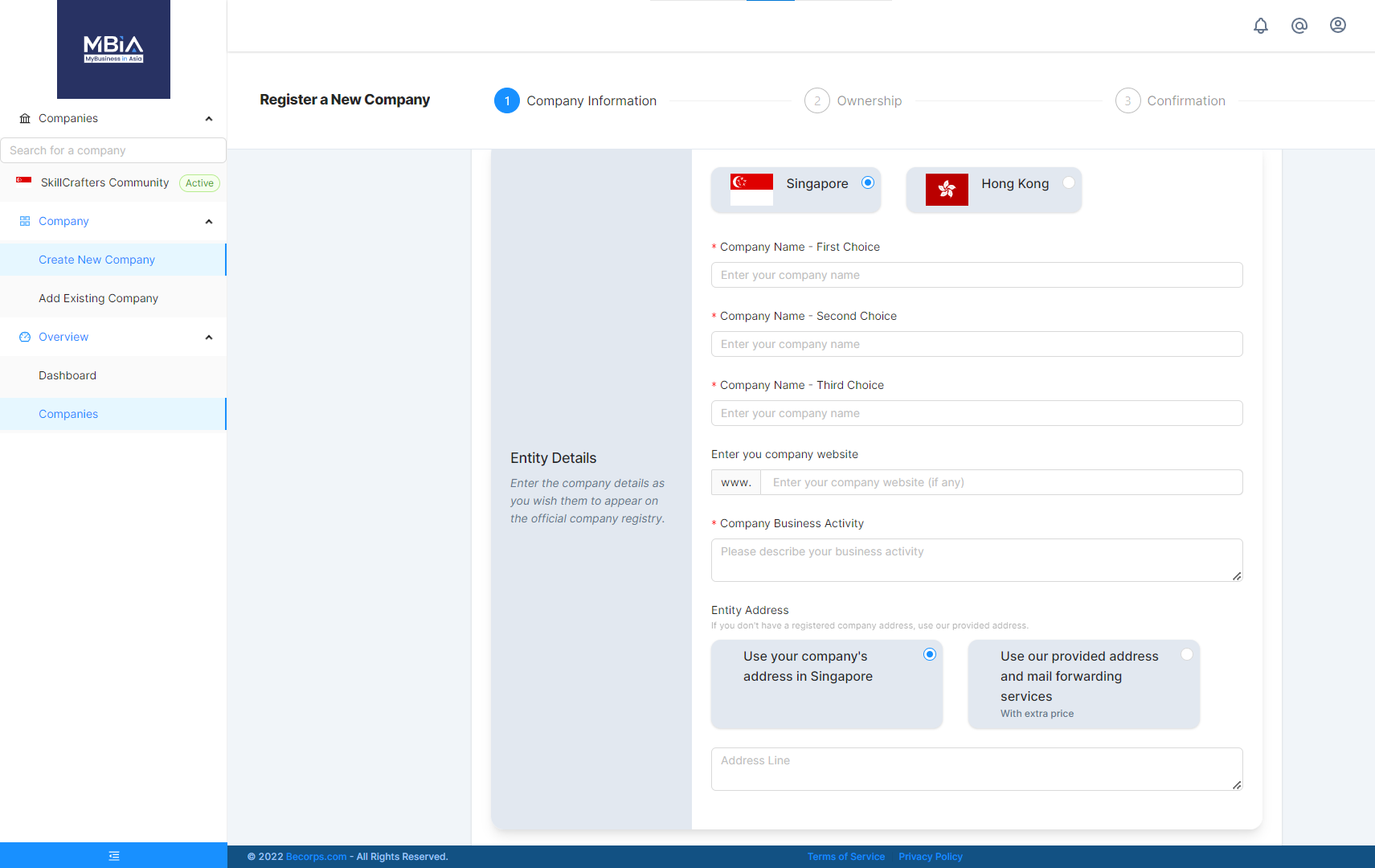

This is how we get your company registered

You company incorporation is digitalised and streamlined through our in-house corporate secretarial services platform.

Follow the 4 easy steps and we will manage the rest for you!

Select your plan

Select the plan that suits you most, based on your budget and needs

Provide company details

Send us all your company details and provide as much information as possible. The more, the better !

We fill out an application and send it for you to e-sign

Your company registration is completed!

Your business gets registered within a few days!

Based on your needs, we will open for free a business account to start your operations as soon as possible!

Save time and money

Your company is now incorporated!

You have access to all your documents on the platform and can monitor any past, pending and coming items and issue new requests to your experts!

Frequently asked questions

Can’t find the answer to your question? Contact us now!

Can you tell me more about the Company Secretary?

Firstly, it is mandatory to have one secretary company, who must be a Singapore resident and also be a physical person.

The company secretary is a key role in Singapore for the internal governance and running business of the local company. Responsible for ensuring the legal compliance of the company with the Singapore authorities and the law, the Secretary also operates as a key advisor between directors and shareholders. He ensures the statutory and regulatory requirements of the company by the annual returns filing with the authority Accounting and Corporate Regulatory Authority (ACRA). He implements the board and members resolutions.

Read more: The key role of the company secretary in Singapore

Can you tell me more about the Registered Address?

As part of the requirements for incorporating a company in Singapore, the Companies Act provides that every limited company (and LLP):

- shall have a registered office address in Singapore from the date of the company incorporation and throughout its existence. A registered office address is a valid address lodged with the ACRA at the incorporation of the company.

- As official address of the company, it is where all communications and official notices are addressed and also the place where the company’s or LLP’s (Limited Liability Partnership) registers and records are kept.

- The registered office address must be a physical address office in Singapore, therefore the postal office box addresses are excluded.

- The registered office address is not necessary the same place where the activities of the company are conducted. Any change must be updated with the ACRA within 14 days from the date of the change.

Virtual office is the choice of most foreign company in Singapore, this is possible by using the office address of their company secretary as their registered office address and as the place for the company’s records to be kept.

Read more: Registered office address for companies in Singapore

Can you tell me more about filing obligations in Singapore?

As a company director or finance professional, there are a range of filing obligations to note. These include company registration confirmations, filing of accounts and tax filings. This mean that sending these documents to the appropriate governmental agencies is mandatory.

Annual accounts: Annual accounts should be completed each year.

Annual Return Filing: All Singapore incorporated companies (except those which are exempt) are required to file financial statements with ACRA annually. The filing of annual return for non-listed companies is 7 months after the company’s financial year-end.

Tax Filing: The first is the filing of your Estimated Chargeable Income, or ECI. ECI is an estimate of the taxable income, after deducting allowable expenses. This filing is due three months after your company’s year-end date.

The main tax filing of the year is due on the 30th of November. Please note that all companies are required to file electronic tax returns, and as such there is no extended deadline until the 15th of December as in previous years.

It is important to complete the accounting as soon as possible after the year-end to allow sufficient time for review and audit (if required).

Read more: Filing obligations in Singapore

What are the minimum requirements to incorporate a private limited company in Singapore?

In order to open a company in Singapore you will need to have:

- 1 to a maximum of 50 shareholders, natural or corporate entities (no nationality requirement);

- A minimum paid up capital of SGD1.

- 1 Singapore Resident director being an individual, who is a Singapore citizen, a Singapore permanent resident or an Employment Pass holder.

- 1 qualified resident company secretary.

- 1 local registered address where are kept the registry of the company.

Read more: How to set up a Private Company Limited by Shares in Singapore?

Do I need an office in Singapore to start my business activity?

In order to comply with the Singapore Act, each company must have a local Registered office Address where registers, records are kept, and all communications are addressed. The registered office is an address in Singapore, it can be a virtual office offered by your company secretary, a physical office directly rented by yourself.

The registered office address is not necessarily the same place where the activities of the company are conducted. Note that the registered office address must be accessible to the public and always updated with the ACRA.

Companies and directors that fail to comply with this requirement may be fined up to S$5,000.

Read more: Requirements for registered office address in Singapore

Can the company bank account be situated abroad?

You may choose to open the company bank account in another jurisdiction than Singapore. However, having a local bank account may help your business in its day-to-day operations especially if you intend to have an economic substance in Singapore (employee, office, activities…).

What are the annual requirements for my company?

In Singapore, a private company limited by shares must comply with certain statutory filing requirements. The companies shall on an annual basis:

- Prepare and file a corporate tax return for tax purposes;

- Prepare and file an Annual General Meeting and an Annual Return reporting any changes in their particulars (i.e. change of registered address, new company secretary, share capital increase, new shareholders, etc.).

- There is an audit exemption, for companies with a turnover of less than SGD 5 million and whose shareholders are only natural persons; and for dormant companies.

How do I close my company?

You may decide to strike off your company for various reasons. Strick off your company will require clearing up a few steps, during which you need to keep appointed the resident director, the local company secretary and have a local registered address.

The process presupposes the company has no outstanding debt with government agencies, and has stopped its activity. The Company may be removed from the register only after confirmation that the Company has no longer any assets or liabilities.

The strike-off procedure will require to be published in the Gazette for approximately 4 months before to be fully deregistered.

What is counted as an accounting transaction?

Our methodology to compute the total numbers of transactions of your company within a financial year, is based on the following elements:

– Number of bills, receipts,

– Number of sale invoices

– Number of manual journals we will need to perform (depreciation of fixed asset, provision…)

Can I receive a salary as director of the company?

As a director of a Singapore company, you may be receiving a salary, under a labour contract. Please note that your time spent in Singapore will have tax implications on the salary received. The taxes may vary depending on whether you are or not considered as a tax resident in Singapore.

Is my company part of a group exempted from audit in Singapore?

The audit exemption in Singapore is allowed for a company meeting 2 of the 3 criteria:

- total annual revenue ≤ $10m;

- total assets ≤ $10m;

- no. of employees ≤ 50.

As part of a group; the company and the group shall meet 2 of the 3 criteria on a consolidated basis for the past 2 financial years.

Read more: Audit obligations, requirements and exemptions in Singapore

Shall I wait for my company bank account to be open before paying the entire capital of the company?

The capital of the company is considered paid when the sum related to the shares allotted is received on the company bank account.

However, share capital can be issued without full payment from shareholders, the part that is not paid-up will remain owed by the shareholder to the company.

What is the RORC obligation in Singapore?

The RORC is a register containing the particulars of the company’s registrable controller(s), also commonly known as beneficial owner(s). The Registrable controller is identified as the beneficial owner (individual or corporate entities) of the company that:

- Have an interest in > 25% of shares in a company; or

- Hold > 25% of members’ voting rights in a company; or

- Can exercise significant influence or control over a company.

The information on the RORC must be lodged with ACRA within two business days after the entity has set up its RORC, and any change shall be updated.

Is it necessary to designate a Data Protection Officer (DPO) in Singapore?

Designating a DPO is an important step for organizations to ensure that they are complying with the PDPA, protecting the privacy of individuals’ personal data and reporting data breaches to the Personal Data Protection Commission (PDPC).

In addition to being a legal requirement, designating a DPO can also help organizations to build trust with their customers and stakeholders by demonstrating their commitment to protecting personal data.

The non-appointment of a DPO can be followed by penalties of up to SGD 5,000.