Hong Kong’s reputation as a magnet for international commerce owes much to its tax-friendly environment. In 2018, the Hong Kong government introduced a unique tax system that aimed to reinforce this tradition, the Two-Tiered Tax Rates Regime. The new system has caught the attention of many taxpayers, particularly small and medium-sized enterprises (SMEs), who recognize its potential to not only streamline tax obligations but also catalyze their expansion strategies within the dynamic Hong Kong marketplace.

In this article, we will go through some keys ideas:

- What is a two-tiered tax rate?

- Two-tired profits tax regime in Hong Kong

- Connected Entities

- Conclusion

What is a two-tiered tax rate?

Two-tiered tax rate regimes aren’t a new concept as many countries, such as the United States, have utilized progressive tax structures for decades. The fundamental goal of progressive taxation is to promote fairness by ensuring that individuals contribute proportionately based on their income level: higher earners are subject to higher tax rates, while lower earners are taxed at a reduced percentage of their income.

The two-tiered tax rates regime offers benefits to larger corporations as well. Despite being subject to the standard profits tax rate on earnings exceeding HK$2 million, the reduced tax rate on their initial HK$2 million of profits serves to decrease their overall tax burden. Consequently, this provides these companies with additional resources that can be allocated towards research and development, recruitment of new personnel, and scaling up their business activities.

Overall, the two-tiered tax rates regime represents a positive move for Hong Kong’s economy. By offering reduced tax rates for SMEs, the government encourages entrepreneurship and innovation, while also ensuring that larger companies aren’t unduly burdened by hefty tax obligations. It’s a win-win scenario for all parties involved, making it difficult to find fault with such a beneficial arrangement.

Two-tired profits tax regime in Hong Kong

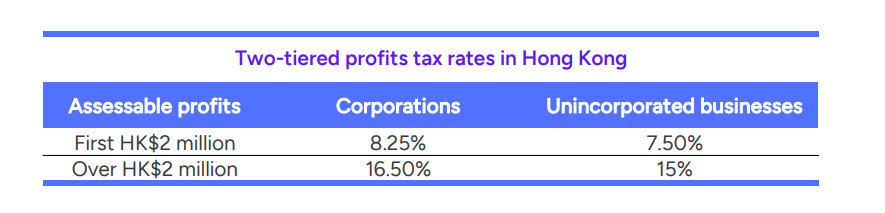

The new regime encompasses both corporate entities and unincorporated businesses, taking effect from the 2018/19 assessment year (on financial years ending between April 1, 2018, and March 31, 2019) with the following provisions:

- For corporations, the first HK$2 million of profits will be taxed at one-half of the current tax rate (i.e., 8.25%) and the remaining profits will continue to be taxed at the existing 16.5% tax rate.

- For unincorporated businesses, the first HK$2 million of profits will be taxed at one-half of the current tax rate (i.e., 7.5%) and the remaining profits will be taxed at the existing 15% tax rate.

To prevent multiple entities within a connected group from benefiting from the half-rate reduction, the legislation defines “connected entity” extensively. Consequently, the group must elect a single entity to benefit from the reduction, with this election being irreversible for the specified assessment year.

However, certain taxpayers, such as those under other preferential half-rate tax regimes (e.g., professional reinsurance companies, captive insurance companies, corporate treasury centers, and aircraft leasing companies), are excluded from the two-tiered tax regime. Furthermore, profits derived from qualifying debt instruments already taxed at concessional rates (7.5% or 8.25%, as applicable) are also exempted from this regime.

Connected Entities

In Hong Kong, businesses have various options for collaboration, such as partnerships or joint ventures, which offer benefits like pooled expertise and expanded market reach. However, these alliances also pose tax challenges.

Under the two-tiered tax rates regime, connected entities are subject to the same limit on tax rate reduction. This ensures fairness in the tax system and prevents potential abuse. For example, if two companies are engaged in a joint venture, they are treated as a single entity for tax purposes. Profits up to HK $4 million are taxed at 8.25%, but any excess beyond this threshold incurs a 16.5% rate.

So, when considering partnerships with other businesses, it’s essential to understand and adhere to these regulations to maintain compliance, avoid penalties, and ensure smooth business operations.

Conclusion

Hong Kong’s two-tiered tax rates regime offers a welcome tax incentive and no doubt will help relieve the tax burden for small and medium-sized enterprises in particular. It’s crucial for businesses with interconnected entities, such as corporate groups, to reassess their current setups. Under this regime, each group needs to designate one member to enjoy the reduced tax rate. For further details and support, take a look at the FAQ by The Commissioner of Inland Revenue, or feel free to reach out to MBiA, our team of tax advisors is readily available to assist you.

The article contains the most recent updates available, extending up to 2024.